If the total rent paid exceeds Rs 1 lakh annually, it is mandatory to quote landlord’s PAN to claim an exemption.

If the landlord does not have PAN, he has to give a declaration of the same. Landlord’s PAN is compulsory if the paid rent is more than Rs 1 lakh annually or Rs 8,300 monthly. You need not affix revenue stamp if the rent has been paid in cheque. Also, affixing revenue stamp is mandatory if the cash payment is more than Rs 5,000. Generally employer asks for rent receipts on quarterly basis but employee can also provide it monthly, too. Rent receipt is mandatory only if the employee receives HRA more than Rs 3,000. Rent receipt for every month is not compulsory, employer may ask for rent receipt of atleast four months.

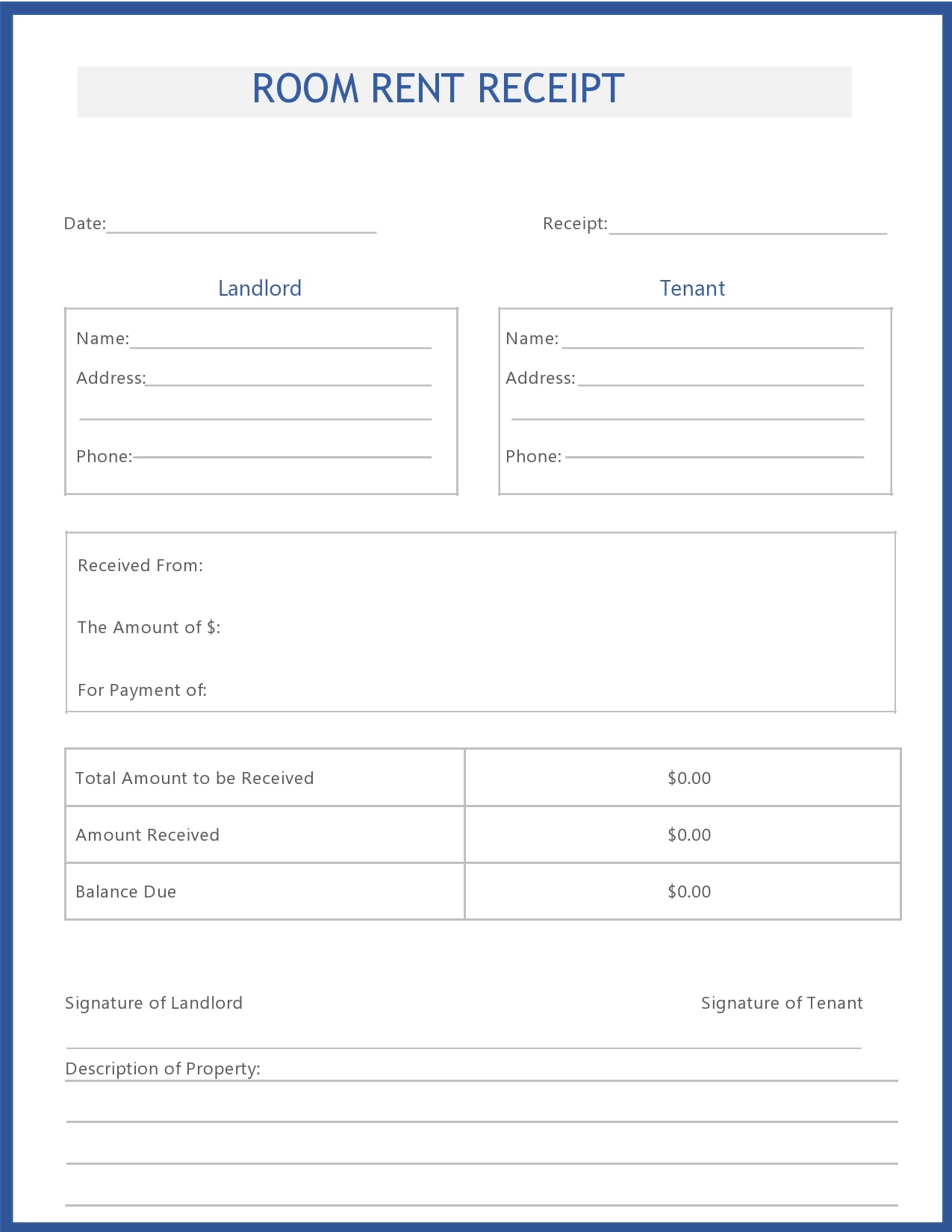

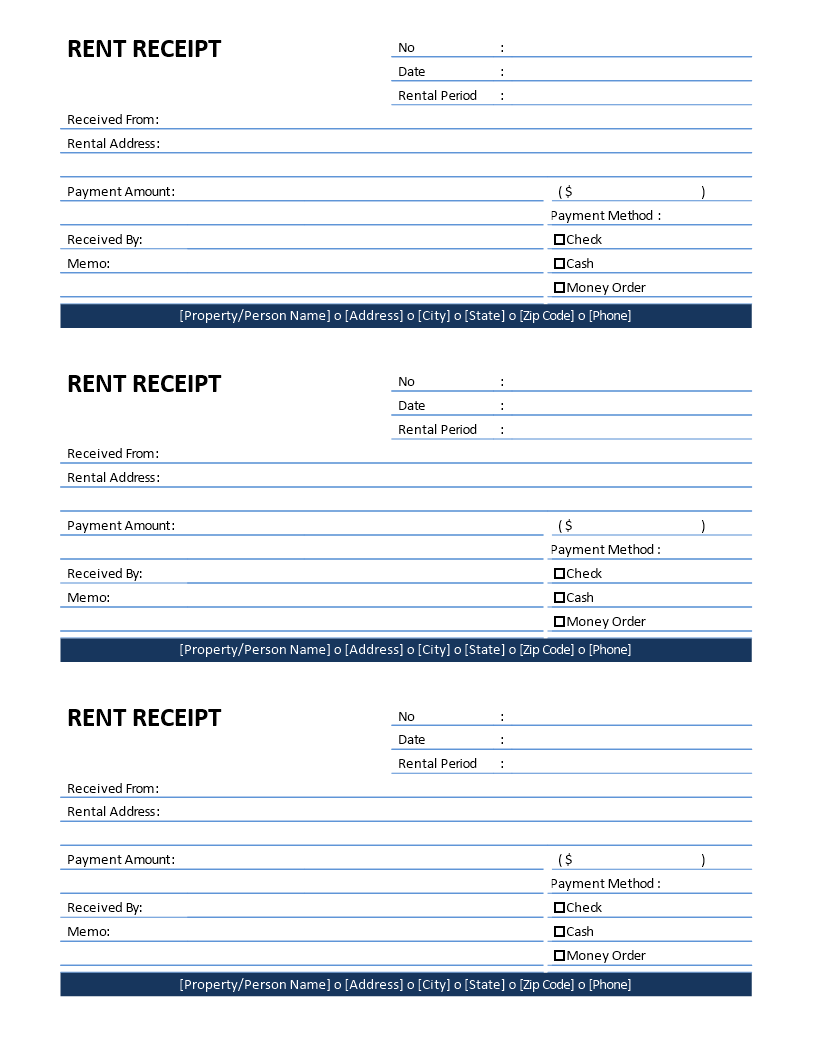

The rent receipt should be affixed with revenue stamp if the cash payment exceeds Rs 5,000. While rent receipt for HRA exemption does not have a standard format, it should contain basic information, including landlord name, rent amount, address of the rented place, landlord’s PAN details and time period for which rent is received. If an individual is paying more than Rs 1 lakh as annual rent, then it is mandatory to quote landlord’s PAN in the declaration form. Since rent receipts act as a proof of payment to the landlord, this can be used to avail of HRA exemption.

0 kommentar(er)

0 kommentar(er)